Cash movement statements are very important as they offer essential information about the cash inflows and outflows of the company. This info is crucial in generating crucial choices about investing, investments, and credit rating.

Cash equivalents have specific Rewards about cash that make them far better for many investors. Nevertheless, both equally kinds of monetary instruments are really comparable and produce in the same way very low yields.

An organization must be capable of offer or liquidate a cash equivalent straight away on need with out dread or materials loss on the product. Cash equivalents are really small danger property without the need of meaningful cost fluctuations.

Having said that, assuming that cash has been lowered for exceptional checks determined by the non-authoritative AICPA assistance talked over previously mentioned, if a zero equilibrium account is linked to a financial institution overdraft credit score facility and checks presented for payment are right away payable beneath the credit facility, the “reserve” overdraft will be, in material, a “financial institution” overdraft.

Decide on a bit below and enter your search phrase, or to go looking all simply click Fiscal statement presentation

It tells creditors and analysts the worth of latest property that might swiftly be changed into cash and what share of the corporation’s latest liabilities these cash and in close proximity to-cash property could protect.

Determining the proper compensation metrics to track is an important phase toward good and equitable payment. This really is why we’ve put collectively a cheat sheet of twelve vital payment metrics...

CCE is a crucial fiscal amount for a company, because the total assists traders and companies decide how properly a company is positioned to take care of small-expression cash desires.

Nevertheless, this could also mean that a corporation is investing or growing which calls for it to spend some of its resources.

Calculations A lot less than one There are additional existing liabilities than cash and cash equivalents when a firm's cash ratio is fewer than just one. Inadequate cash is available to pay back short-expression debt.

Upgrading into a paid out membership offers you access to our extensive selection of plug-and-Participate in Templates meant to ability your general performance—as well as CFI's full class catalog and accredited Certification Systems.

The greenback amounts of cash equivalents has to be recognized. Therefore, all cash equivalents must have a recognised market place cost and shouldn't be matter to significant selling price fluctuations.

Cash equivalents often have a bit total cash higher yields than cash. Even getting a single-thirty day period Treasury bills might yield bigger premiums than what an organization may get on their own personal savings account.

This is due to the lender can flip offered checks into legal liabilities with out even more action from the payor. In that case, adjustments inside the overdraft will be classified as funding functions while in the statement of cash flows and the overdraft could well be introduced as personal debt to the stability sheet.

Kelly McGillis Then & Now!

Kelly McGillis Then & Now! Anthony Michael Hall Then & Now!

Anthony Michael Hall Then & Now! Danica McKellar Then & Now!

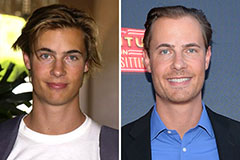

Danica McKellar Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now!